April 2025

Boost to new student finances in the face of bill rises

By Claire Huggins

Share post:Read time: approx 7 mins

As the news brings more announcements of further increases to household bills, University College Birmingham has announced data-led research that shines a light on the financial challenges faced by students and the people that support them.

With the Bank of England predicting that consumer inflation will rise to 3.7% between July and September 2025, this is will inevitably impact the UK’s 2.94 million students - and the 3.8 million parents and carers that support them through their education.

Research estimates that student expenses could increase by £400 per year by September, costing almost three million students an extra £99.5 million.

University College Birmingham’s research, factoring in the anticipated 3.7% consumer inflation alongside the estimated 4% inflation figure for food items, revealed that the average predicted price increase for UK students will be £33.85 a month.

This works out at £406.20 a year - a large sum of money that most students will struggle to afford. Meaning that many higher education pupils may have to turn to their parents for support.

However, for parents who are already financially stretched to their limits, finding the extra £34 a month needed to support young people through university could be a tipping point between the cusp of financial stability and debt.

The introduction of the University's £5,000 Cost of Living Allowance is a timely initiative for the September 2025 student intake.

|

Student Weekly Monthly Expenses |

Current cost per month |

Predicted cost by September per month |

Predicted price increase per month |

|

Food |

£103 |

£107.12 |

£4.12 |

|

Transport |

£70 |

£72.59 |

£2.59 |

|

Household bills |

£76 |

£78.81 |

£2.81 |

|

Rent |

£540 |

£559.98 |

£19.98 |

|

Clothes |

£32 |

£33.18 |

£1.18 |

|

Phone bill |

£16 |

£16.59 |

£0.59 |

|

Going out |

£51 |

£52.89 |

£1.89 |

|

Health and wellbeing |

£18.57 |

£19.26 |

£0.69 |

|

Total |

£906.57 |

£940.42 |

£33.85 |

Table 1: UK students’ predicted monthly outgoings from September 2025.

The research also analysed how predicted price increases would impact students in some of the UK’s biggest university cities, establishing which pupils could be especially affected by inflation when September arrives.

Unsurprisingly, London’s predicted price increase for the new academic year will be the largest, with the capital city’s students paying out an extra £50.84 a month. This equates to £610.08 a year on top of their current spending habits.

The next largest price increases were found in Edinburgh (£37.07 extra per month) and Manchester (£34.59 extra per month).

However, in better news, while Birmingham’s students will still see a £335 yearly increase on their everyday expenses (£27.93 per month), this represents the lowest predicted rise of the top five cities; further financial support initiatives like the Cost of Allowance, will help to bolster student finances further.

|

City |

Current cost per month |

Predicted cost by September per month |

Predicted price increase per month |

|

London |

£1,365.61 |

£1,416.45 |

£50.84 |

|

Birmingham |

£746.57 |

£774.50 |

£27.93 |

|

Manchester |

£926.57 |

£961.16 |

£34.59 |

|

Edinburgh |

£993.57 |

£1,030.64 |

£37.07 |

|

Cardiff |

£818.57 |

£849.17 |

£30.60 |

Table 2: Comparison of students’ outgoings, as impacted by inflation, by city.

"Our Cost of Living Allowance is an undoubted boost to student funds especially as it doesn't have to be paid back, but there are many university facilities available for students to use that can ease the costs of everyday living."

Predicted inflation is going to have a huge impact on UK students’ bank accounts, and a ripple effect for parents. To help combat this, the Director of Student Support and Wellbeing, Ben Pithouse, has shared useful tips for parents who wish to help lower student expenses in anticipation of these financial changes:

● Take full advantage of your university facilities on offer

“There are many university facilities available for students to use that can ease the costs of everyday living. For example, there are study spaces that are warm and quiet, and discounted hair and beauty treatments. The library has books for studying and for leisure, which could free up some much-needed cash, and like many universities, we offer competitively priced food in our campus-based outlets. Our students are also entitled to a free breakfast, and free soup and bread in the afternoons. These will save money when compared with local restaurants or takeaways."

● Switching on this one bank setting can save students £70 per month

“Most UK student bank accounts have a setting called RoundUps (or Save The Change for Lloyds bank users). By enabling this, students will see spare change from each transaction they make automatically moved to their savings account. If users make five purchases a day and 50 pence is moved to their savings with each one, this can add up to £70 a month in their account. This will help combat the inflation prices by fully covering September’s price increase, with £36 to spare.”

● Always do food shopping with a planned list

“Grocery shopping with a list that details exactly what is needed can help students stay on course when it comes to maintaining a budget. It’s key that students don’t get swayed by offers for things they don’t need. It can also help if prices are checked online first - students can add things to an online basket for their shop of choice, making sure that the final price works out with what they can afford, before taking this list and doing the shop in person.”

● Explore student discount apps for huge savings

“Discount apps are an easy way to save money on everyday essentials, such as food, clothing, travel and wellbeing items. Apps like UNiDAYS and Student Beans offer huge savings at food shops like M&S, Just Eat and Deliveroo, which can balance out price increases caused by UK inflation. It’s also worth taking a look at student discount cards, such as TOTUM and discounted rail travel for students. Some student bank accounts offer free railcards as a signing up bonus, including Santander’s Edge Student current account. These offers make a great difference in lowering everyday costs.”

● Explore bursaries, scholarships and grants

"The University's Cost of Living Allowance is an undoubted boost to student funds especially as it doesn't have to be paid back. But most institutions offer other support initiatives such as grants, bursaries and scholarships that aren't always linked to high grades, course choice or household income."

Check out our latest news stories

Blog | Our 7 top tips for exam preparation

Exams just around the corner? Feeling anxious, or like you’re not sure how to prepare? Don’t worry! Our top tips will help you navigate this stressf…

Read more

Boost to new student finances in the face of bill rises

Cost of Living Allowance is one of many measures the University offers to help ease new student financial stress.

Read more

Students and apprentices bag nine medals at huge culinary competition

Just one Cornetto…cocktail and a whole heap of hard work was what it took to come away with a multi-medal haul from the I…

Read more

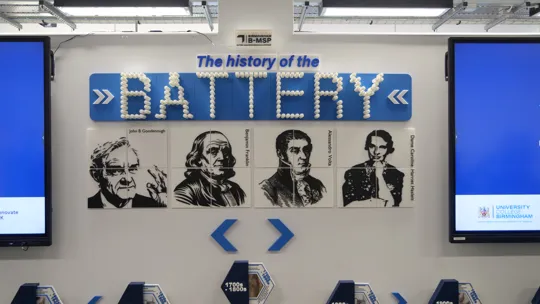

University launches UK's first accredited battery skills programme

In the face of Net Zero aims and the increasing demand for renewable energy, University College Birmingham has launched the…

Read more

Students get incredible hands-on experience at Event Week Live at NEC

Future events professionals from the Department of Travel and Tourism were given the chance to delve behind the scenes at…

Read more

Dietetics students learn from the professionals at networking event

University College Birmingham students and registered dieticians gathered at the Restaurant at the Birmingham College of Fo…

Read more